Before you dive into Part I, write your name and Social Security number at the top of the form.

(If you’re filing an amended return for a previous year, note that prior to 2018, you could not file Form 8962 with Form 1040EZ.)įorm 8962 is divided into five parts. And if you’re required to file Form 8962 you can’t use Form 1040-PR, or Form 1040-SS. This is the case even if you otherwise wouldn’t need to file taxes. If any of these conditions apply to you, you must file Form 8962 with your income tax return. APTC was paid for someone (including you) for whom you told the marketplace you would claim a personal exemption and neither you nor anyone else claims a personal exemption for that person.APTC was paid during the year for you or someone in your tax household.You must file Form 8962 with your 1040 or 1040NR if any of the following apply: However, if you’re eligible for more money in PTC than was paid in APTC, you could get the difference back in your tax refund. In that case, when you use Form 8962 to reconcile your PTC eligibility with the APTC already paid, you may have to repay the difference. On the other hand, if, say, your income rose and you didn’t report it, the government might have been overpaying APTC to your or your insurer. If you didn’t, you might have been receiving too much or too little in APTC. If either your income or personal exemptions changed during the year, you should have reported those changes to the marketplace. The marketplace determined your eligibility for a subsidy, which is also your advance payment or APTC, based on what you entered as your income and personal exemptions. When you signed on to the Health Insurance Marketplace to enroll in a qualified health plan, the system told you whether you qualified for a subsidy. If you have marketplace coverage and received a 1095-A form documenting that coverage, you may be a candidate for the PTC.

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

You also can’t use Form 8962 if you get coverage through your employer and received a 1095-C form.

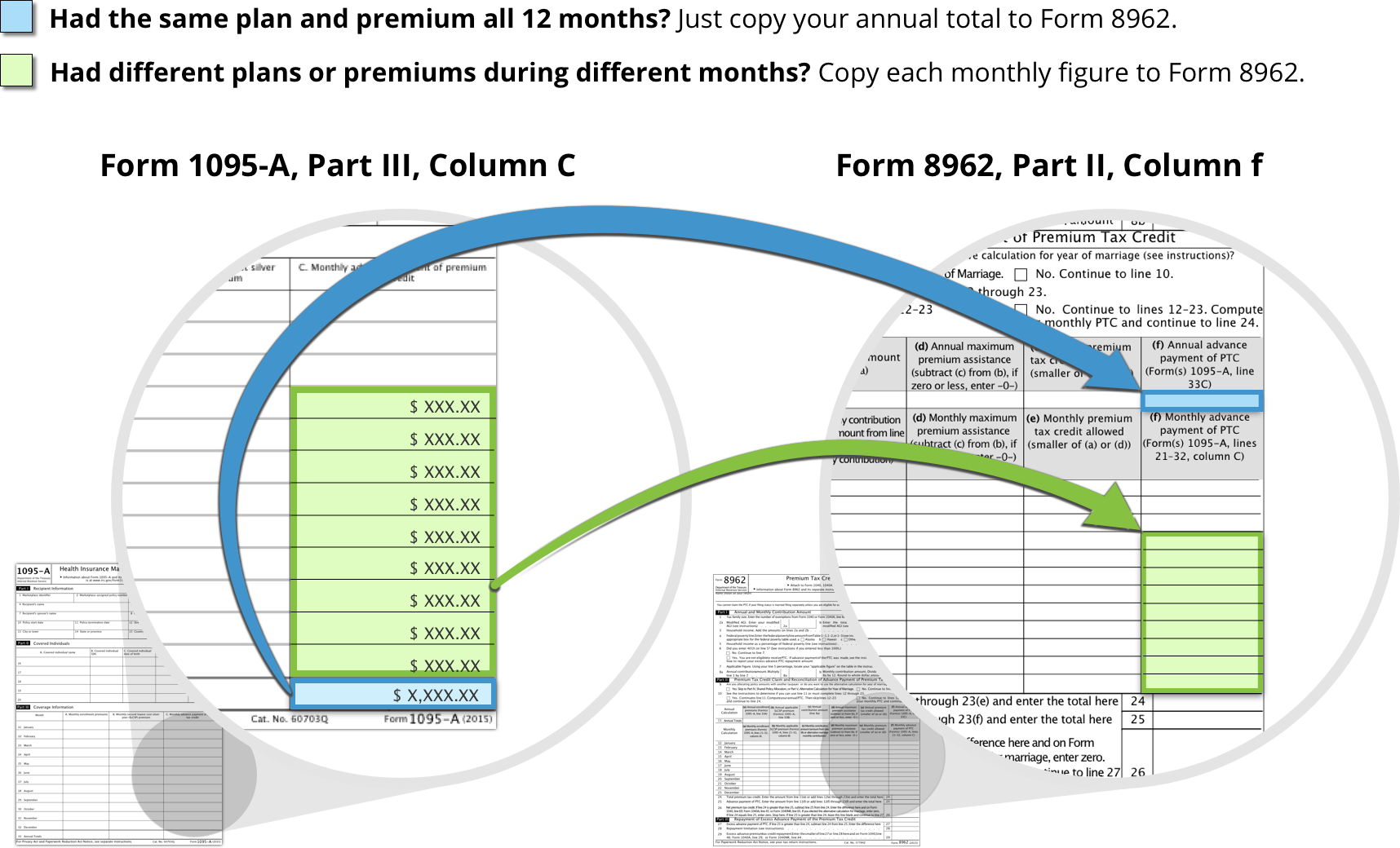

You can’t use Form 8962 if you get health insurance through another insurer and received a 1095-B form documenting your health insurance coverage. If you used or your state’s health insurance exchange to get coverage, you may qualify. Only those who have health insurance through the Affordable Care Act Health Insurance Marketplace (also known as the exchange) are eligible to use Form 8962, and not everyone who has marketplace coverage can qualify. Not everyone can file Form 8962 and claim the PTC. With that amount, they’re then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit (APTC) that have been made for the filer throughout the year. The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit (PTC) amount with their federal income tax return.

0 kommentar(er)

0 kommentar(er)